The Future of Conversational Banking: Secure, Automated, and Personal.

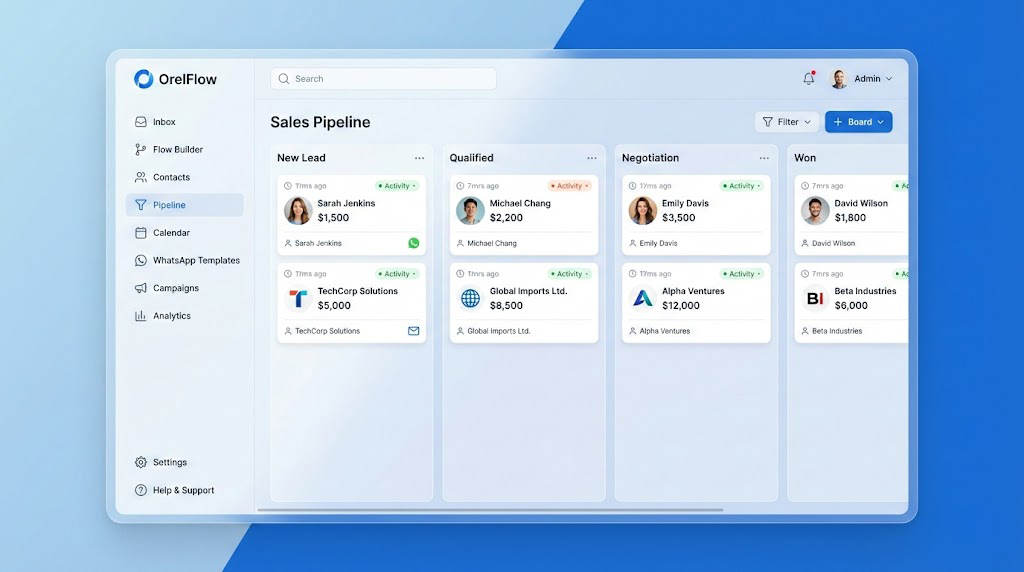

OrelFlow empowers banks, credit unions, and FinTechs to transform customer engagement across the entire lifecycle, from onboarding to support. Leverage our enterprise-grade security and Meta Business Partner status to deliver timely, personalized, and compliant conversations at scale.

Digitally Onboard Customers with Confidence

In financial services, the speed and security of onboarding are paramount. OrelFlow’s Multi-Channel Messaging platform integrates secure, end-to-end encrypted communication across WhatsApp, Email, and WebChat, accelerating the verification process.

Our Visual Flow Builder allows you to create sophisticated, multi-step customer journeys—like KYC/AML documentation submission, signature capture, and identity verification—without writing a single line of code. This dramatically reduces dropout rates and minimizes manual processing time.

The integration with tools like Google Sheets and CRM platforms ensures that captured data is immediately and securely logged, while our Enterprise Security features maintain the highest compliance standards, giving your customers peace of mind throughout the process.

Conversational Security That Meets Regulatory Standards

Security is non-negotiable in financial services. OrelFlow is built on a foundation of bank-level security and rigorous compliance protocols, including end-to-end encryption and role-based access control, ensuring your data and your customers’ data are always protected.

Our status as a Meta Business Partner and WhatsApp Business API Partner guarantees you are using official, secure, and compliant channels for all customer communications, avoiding risks associated with unauthorized or grey-route messaging.

With audit trails and advanced user management, you can easily comply with financial regulations and provide proof of secure interaction for every transaction, inquiry, or confirmation sent through the platform.

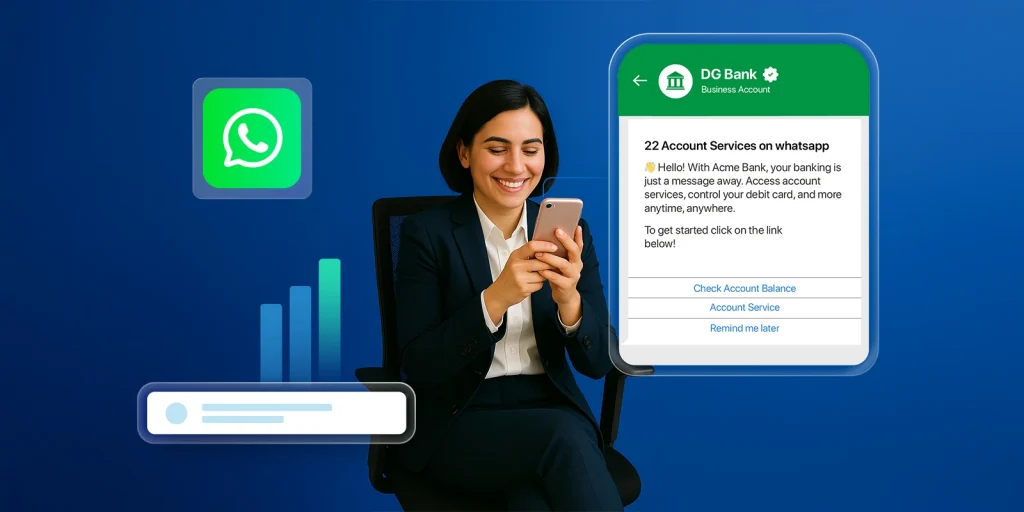

Intelligent AI Agents for 24/7 Financial Support

Augment your human agents with OrelFlow’s sophisticated AI Agents powered by Gemini and OpenAI. These intelligent chatbots handle up to 80% of routine inquiries instantly, from checking account balances and transaction histories to providing interest rate information.

Our unique AI Flow Assistant can instantly generate complex automation sequences for sensitive tasks like payment reminders or soft debt collection, ensuring a compliant, empathetic, and timely follow-up strategy. Crucially, the Agent Handoff node ensures any complex or emotional conversation is immediately escalated to a qualified human agent, maintaining service quality and regulatory adherence.

Key Use Cases for Banking & Financial Services

OrelFlow drives tangible results by enabling powerful conversational workflows:

Secure KYC/AML Document Collection: Use WhatsApp Forms and secure Document Message nodes to collect sensitive files and signatures directly in a compliant chat thread.

Instant Account Balance Check: An AI Agent quickly responds to balance inquiries and transaction details via text, ensuring 24/7 access to critical information.

Fraud Alert Verification: Send instant, official WhatsApp notifications for suspicious activity, requiring immediate user confirmation to verify the transaction.

Loan Application Status Updates: Automate personalized updates on application progress and necessary document requests via the customer’s preferred channel.

Soft Debt Collection & Payment Reminders: Deploy empathetic, automated flow-builder sequences to remind customers of upcoming due dates, including flexible payment link options.

Appointment Booking for Financial Advice: Integrate with Google Calendar or Zoho Calendar to allow clients to schedule meetings with wealth managers or loan officers directly from chat.

Credit Card Activation & PIN Reset: Enable verified, self-service flows that allow customers to perform essential card management functions securely within the chat.

Customer Satisfaction (CSAT/NPS) Surveys: Automatically trigger short, conversational surveys after a support interaction to track agent performance and service quality.